Financial reports are an important component in a company. To help you understand the company's financial condition, we have prepared various examples of financial reports.

However, before knowing the various examples, we will also explain in detail how to make the following financial reports.

How to Make Financial Reports

According to Databox, a financial report must be accurate and complete. You can use these financial reports to show the company's performance to old investors and attract new investors.

Here are the right ways and steps to make financial reports:

Start with these three main data

If your company or business has been running for more than three years, add sales information for the last three years.

Meanwhile, if your company or business has just started or is less than three years old, include all sales information while the business is running.

The sales information in question is the selling price, number of products sold, and operational cost calculations. This information can help you understand how much profit you will make based on the number of sales.

You can also use this variety of information to create sales targets or predictions (sales forecast) for the next few months or 1 year.

Write expenses in detail

Sales forecasts are useful for helping you calculate the expenses you have incurred and will incur. Detailed expenses contain fixed costs (certain expenses such as rent, employee salaries, etc.) and variable costs (proportional expenses, for example marketing and promotion costs).

You can also add tax charges in detailed expense information, such as VAT and PBB.

Create a clear cash flow

By using sales information, sales forecasts, and expense calculations, you can create company cash flow.

If your company is still a startup or new, make a cash flow calculation for the next 6-12 months.

Make profit/profit predictions

Profit predictions are quite easy to make. You just have to calculate it using the following formula:

Income - expenses - tax burden

For example:

Company expenses in 1 year: IDR 125 million

Company income in 1 year: IDR 175 million

Tax burden in 1 year: IDR 17.5 million

So, the calculation is: IDR 175 million - IDR 125 million - IDR 17.5 million = IDR 32.5 million.

However, keep in mind that these numbers are predictions. Depending on market conditions, sales figures, and the size of your operational costs, the numbers can show profits or losses.

Ensure inventory data is complete

Include what is in your inventory and the costs incurred to purchase and store it.

Make sure all data is accurate and complete, because this data will also be part of your company's operational calculations. If your business or company operates in the field of multifunctional products, investors will ask for this information.

They want to know even your processes for managing assets and inventory for continued production.

Add the break even point

According to the BBC, the break-even point is the point where total income is equal to total expenditure. In simple terms, the break even point indicates that the company has not made a profit, but has not experienced a loss either.

Break-even analysis can help you identify expenses that will potentially be needed later. This can help you set more reasonable targets, price products more accurately, and avoid making careless decisions.

Examples of Financial Reports

If you need a clearer example of a financial report, here we explain the five types, quoted from Investopedia:

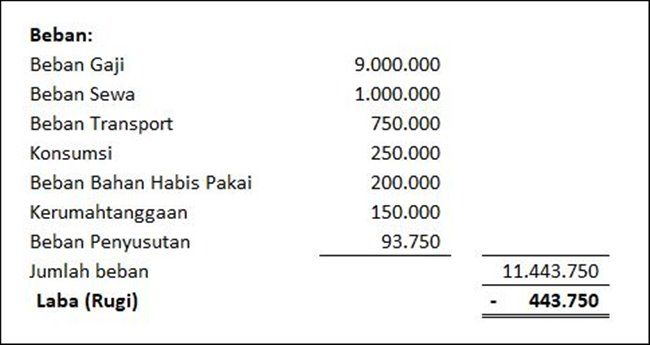

Example of a simple financial report

Source: merdekakeuangan.net

For small businesses and startups, you can follow this simple financial report example. This report must contain important elements related to your business finances. Make sure you include all types of expenses and no matter how small.

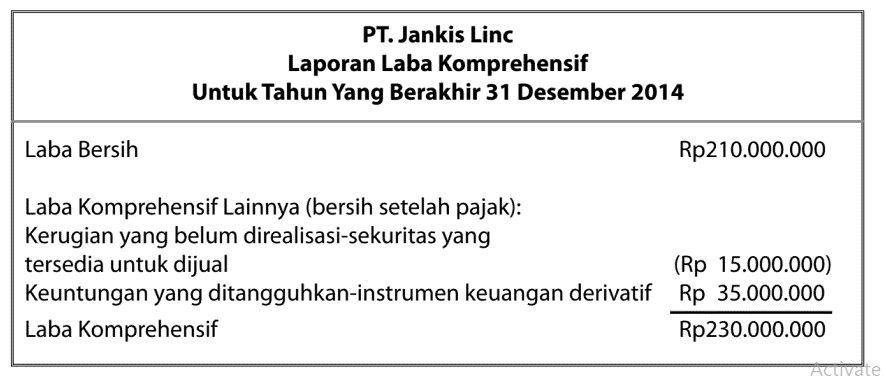

Example of financial report: Comprehensive income/profit

Source: Pintu.co.id

Financial reports related to comprehensive income and profit will show changes in the net finances of your business or company in a certain period.

This financial report will also be shorter and focus on your company's net profit or finances.

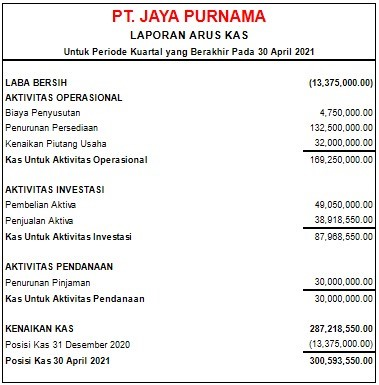

Example of a financial report: Cash flow

Source: OCBC.id

Cash flow is important to ensure whether your company or business is running according to plan. In this example of a financial report, you must list in full and in detail all operational costs, investments, assets and funding for your company.

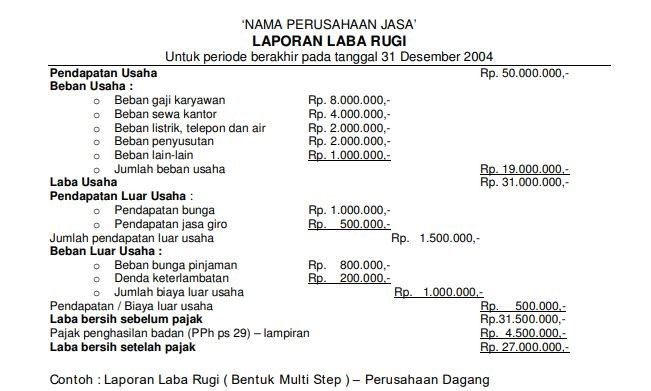

Example of a financial report: Profit and loss

Source: Detik.com

This example of a financial report is most often used because it can show the income and expenses of your company or business as a whole.

This report will provide a factual overview of your company's financial condition. Typically, this report will contain:

- Business expenses (employee salaries, rent, depreciation, etc.)

- Operating revenues

- Outside business expenses (loan interest, late fees, etc.)

- Corporate/business income tax

From all these figures, you can find out your company's net profit.

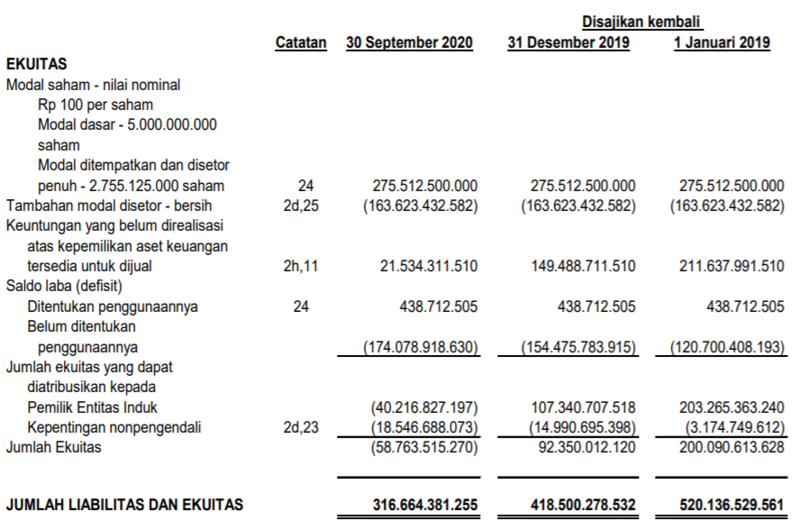

Example of a financial report: Changes in equity

Source: bigalpha.id

Financial reports related to changes in investor equity must include in detail the total equity from one period to another. In this report, investors will be able to find out data about:

- Initial equity

- The company's final income

- Dividend

These are various examples of financial reports and how to prepare them which can definitely help you find out more about the performance of a company or business.

Want to learn more about proper financial reports and how to prepare them?

Join our class and learn how to prepare the best financial reports and get examples.

Join our short program by clicking here now!

.jpg)

.jpg)